It was 28th October 2017, a stormy autumn day in Germany. Strong winds in the evening led to high wind power production across Germany. During the same time, power demand decreased as people retired to bed. Conventional power plants were however still running because of their inflexibility. All this made the wholesale power market price go negative. In this situation, wind parks would have had to pay up to Euro 100/ MWh for their production. Instead, over 7500 wind turbines stopped their production at around 9 pm. Due to this, around 15 GW of power production was curtailed. Next morning, after 10 hours of negative power price, power demand increased, and spot market prices recovered. Wind turbines started production again as if they were monitoring the spot market prices themselves. Such an efficient market and grid integration of renewable power was made possible with the Virtual Power Plant (VPP) technology.

What is a VPP and how does it work?

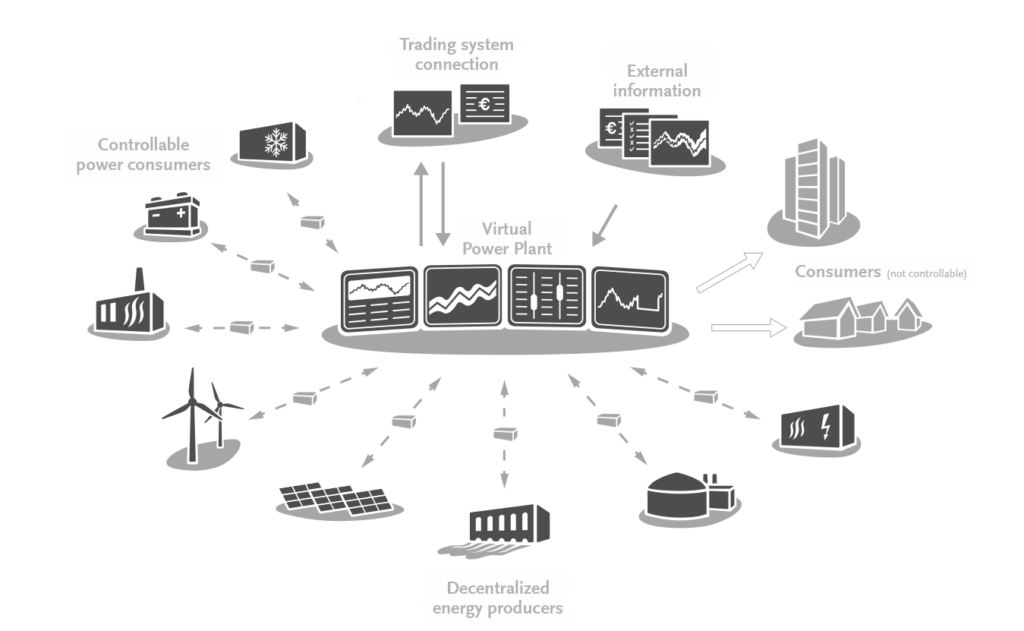

As depicted in the figure below, VPP is a web of decentralized power generation units, controllable as well as non-controllable power consumers, energy storage units and a central control IT system (VPP software). Using real time communication between participating units and the VPP software, the latter is able to monitor, forecast and dispatch the networked units. The portfolio formed by these aggregated units becomes a single dispatchable resource that offers flexibility coming from networked units e.g. ramping up and down of power production and power consumption on short notice. With such characteristics, VPP optimizes generation and consumption, as well as storage assets, maximizing energy production and enabling efficient energy distribution to end users.

Evolution of VPPs in Germany

The concept of VPP was developed in Germany when its renewable power penetration in the grid became significant. eTelligence was an early research project on VPPs which was funded by the German Federal Ministry for Economic Affairs & Energy and was executed between 2008 and 2012. The research project demonstrated a VPP which was able to integrate variable generation operated together with controllable loads, reduce cost of purchased energy for controllable loads, and reduce imbalances of the variable generation due to forecast errors (reductions by 15 per cent in the project). Under the project, IT interfaces between VPP components were also developed.

The year 2012 brought commercial success to VPPs as this was when the renewable power support regulations changed from a fixed feed-in-tariff model to a market-premium model. Here, it was made mandatory for RE plant owners to sell their power on the wholesale market. In addition, RE plant owners were paid an extra bonus to make their plants remotely controllable to react to market signals. The same was made obligatory in 2014. VPP technology with its above discussed features gave a perfect solution to power aggregators/ traders for the market integration of their power assets. Using VPPs, aggregators were able to directly connect to power assets for data acquisition. This real time data access led to optimized power forecasts and a significant forecast improvement was seen after the implementation of VPPs in 2012. Remote control of power plants via VPP gave aggregators the flexibility to control the output of their portfolio as per the market conditions, for instance, shutting down the plants in cases of negative prices. Incorporation of merit order of power plants in VPP allows it to automatically choose the cheapest plants (in the portfolio) to fulfill the desired power volume. The latest development in the field of VPPs is the provision of balancing power with variable renewable power plants like wind turbines.

Opportunities with VPPs worldwide

VPPs are gaining popularity worldwide, not just in Europe. For instance, grid operators in Japan and India have launched VPP pilot projects where they are exploring VPPs to manage their grid fluctuations. Big industrial concerns in the US with their own captive power and controllable loads, are investigating VPPs to optimize their market purchase of power. Operators of electric vehicle charging stations in Europe are exploring VPPs to utilize the flexibility of their connected vehicles.

Creating your own VPP

In Germany, energy&meteo systems GmbH (emsys) has emerged as a market leader in the field of VPPs, with its VPP offering covering a large share (some 1000 assets with some 10 GW capacity) of the installed wind and solar power plants that participate in direct marketing. Emsys provides VPP as a service solution which can be personalized to meet customers’ needs. emsys’s offering in VPP includes the following: connection to distributed power plants through various interfaces; real-time data management; remote control of wind and PV; scheduling; forecast management; energy trading; provision of balancing power by distributed power plants (primary, secondary and tertiary control); and demand side management. Emsys is the first VPP provider to execute primary control using batteries and tertiary control by using wind farms in the German balancing power market. Besides wind and PV, emsys is also serving hundreds of MWs of other kinds of power assets in its VPP, such as biogas, small or large hydro, small CHP, large CHP, gas turbines, batteries etc. We see the role of VPPs as critical to the successful integration of a high share of renewable energy, and are excited about what we see for the future.

Ulrich Focken, General Manager

energy & meteo systems

Germany serves as an exemplary case study for the applications of virtual power plants in power system management. This topic delves into Germany’s successful integration of VPPs to optimize energy generation, consumption, and grid stability through advanced demand response and energy trading mechanisms.