Julia Matevosyan

The November 2018 ESIG blog on “Implementation of Inertia Monitoring in ERCOT – What’s It All About?” discussed the importance of synchronous inertia for a power system. It included the impacts of inverter-based resources on system inertia, and an inertia monitoring tool that ERCOT implemented to track system inertia in real time, forecast it for the upcoming hours, and provide offline analysis of inertia trends. ERCOT has accumulated seven years of inertia data from 2013 to 2019, and this blog provides some insights from the data.

What’s Intuitive about Decreasing Inertia?

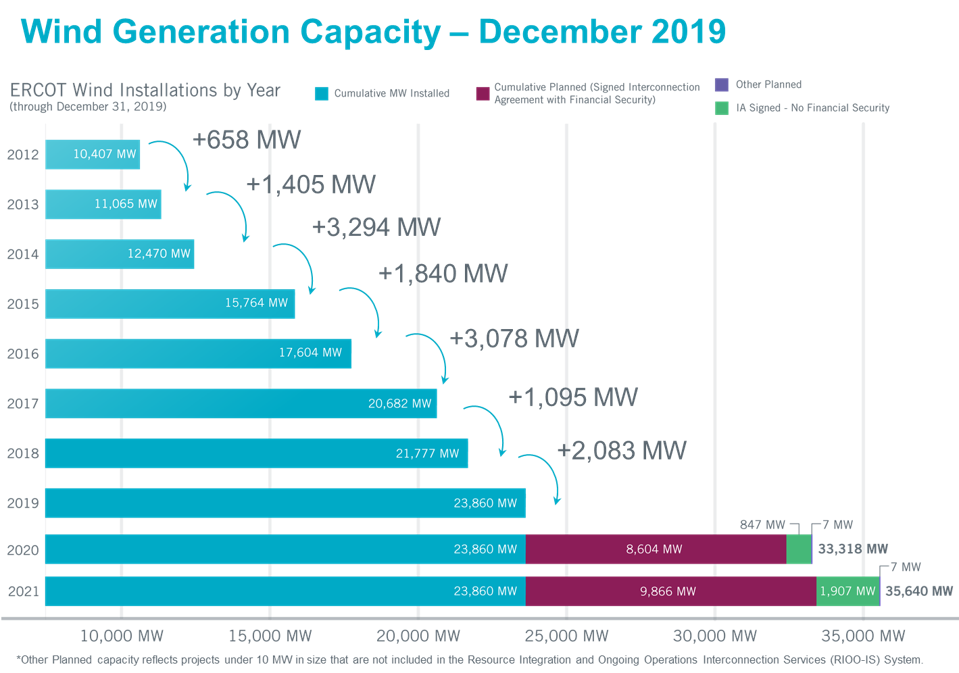

It is intuitive to assume that as the penetration of inverter-based resources grows, these resources would displace conventional synchronous generation in the unit commitment and system inertia would have a declining trend. With all other factors being constant, this is exactly what should have happened, since ERCOT has more than doubled its installed wind capacity between 2013 and 2019.

However, historical inertia data for that period shows that the inertia trend is not as simple as anticipated. In fact, the inertia trend is affected by a number of factors, and the increasing installed capacity of inverter-based resources is only one piece of the puzzle.

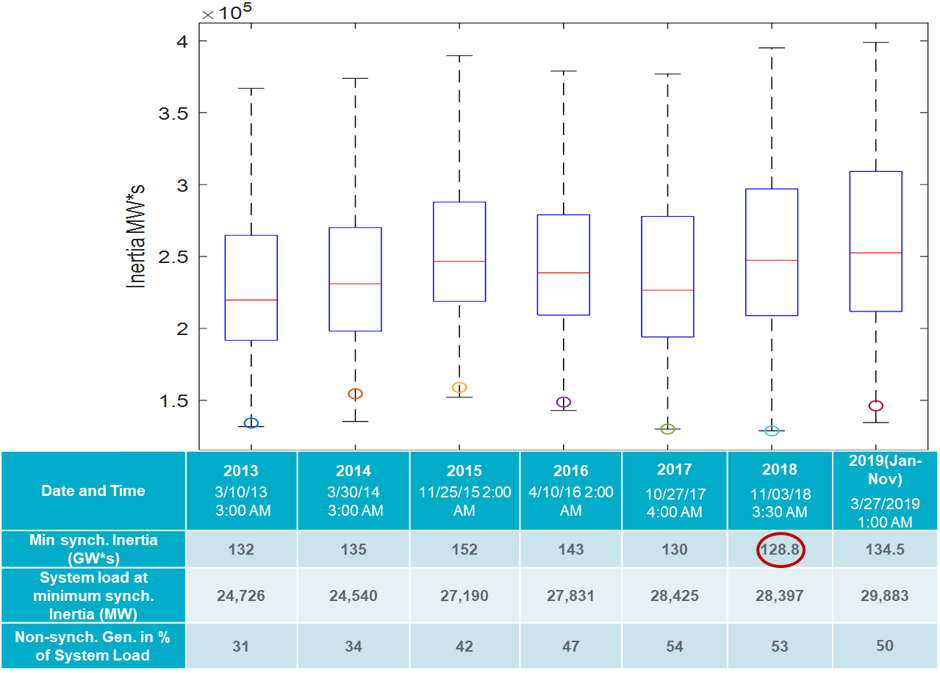

The chart below shows inertia box plots[1] for 2013-2019 and supporting information for the minimum inertia hour in each year. The colored circle near the bottom of each whisker indicates the system inertia during the hour when the highest share of load was served by inverter-based resources in each year. In 2019, it reached 57.87% on November 26 at 3:52 a.m. Note that the instances of maximum inverter-based resource penetration do not necessarily coincide with minimum inertia instances.

The minimum inertia to date was about 129 GW*s during one night in November 2018. This is almost 30% higher than ERCOT’s critical inertia (100 GW*s), which is defined as the inertia level below which existing frequency response mechanisms would not be fast enough to arrest the frequency above the underfrequency load shedding trigger, following the simultaneous loss of the two largest generators on the system.

Why Has the Minimum Inertia Not Decreased Continuously?

From the beginning of 2013 until the end of 2019, ERCOT added almost 13.5 GW of installed wind capacity[2]. If this wind capacity simply displaced 13.5 GW of coal-fired synchronous generation in the unit commitment, it could have resulted in a reduction of total system inertia by about 35 GW*s. However, it is apparent from the box plots shown above that this did not occur. ERCOT load continues to grow each year, primarily due to oil and gas development; this type of load also tends to be fairly constant over a day. As a result, the higher minimum load at night offsets higher off-peak wind output, resulting in higher minimum net load (the remainder of load that needs to be served by conventional generation), which also leads to more synchronous units remaining committed.

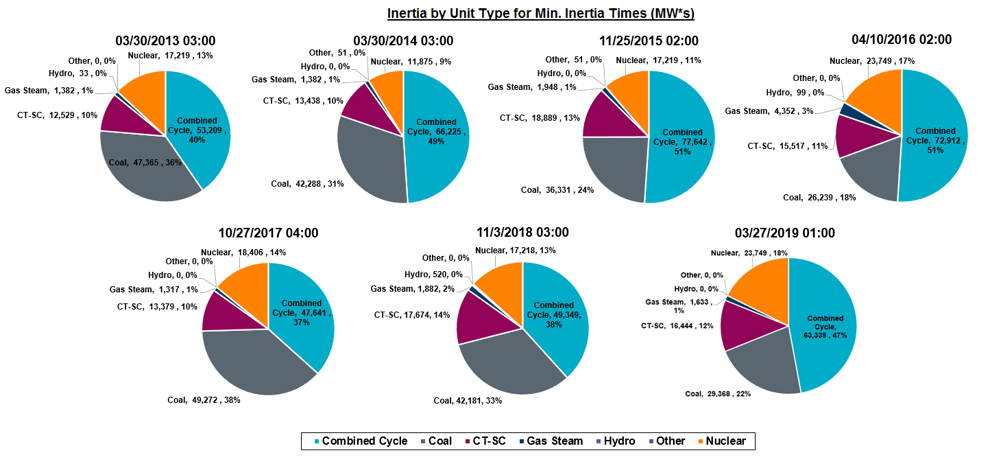

Another reason for a somewhat flat inertia trend is gas-fired generation replacing coal generation in the economic merit order for unit commitment when natural gas prices are low. A typical combined cycle plant inertia contribution is around 1.5 times that of a coal fired unit with the same MW rating. In addition to the impact from natural gas prices, significant coal plant retirements and mothballing occurred at the end of 2017 and in early 2018, totaling slightly more than 5.5 GW of installed capacity. This again resulted in more combined cycle commitment during nighttime compared to previous years.

The shifting of generation share between coal and combined cycle units can be clearly observed from the pie charts below which show the breakdown of inertia by generation technology during the minimum inertia hour in each year. Between 2014 and 2016 this was driven primarily by gas prices, while from 2018 onward, it was also impacted by coal plant retirements. Notably, nuclear units (which have significant inertia contribution) are usually undergoing maintenance during shoulder months, but in 2016 and 2019, the minimum inertia hours coincided with times when all four nuclear units were in operation.

Don’t Forget Base Inertia

Using 2013-2019 inertia data, ERCOT also analyzed the sources of “base” inertia; that is, the inertia of synchronous generation units that are committed at all times and are not impacted by market outcomes. This includes the inertia of nuclear units, units providing frequency containment reserves (Responsive Reserve Service) and restoration reserves (Regulation), and Private Use Networks (private generating units usually at industrial sites). As an example, this analysis showed that PUN units provide a minimum of around 35 GW*s of inertia at all times, which corresponds to more than 30% of ERCOT’s critical inertia.

And the Result Is …

In summary, seven years of inertia data from ERCOT shows that in addition to the power production of inverter-based resources, system inertia trends are also impacted by other system-specific factors such as load growth, conventional unit retirements, natural gas prices, and operational behavior of industrial generation. ERCOT will continue to monitor system inertia going forward and will continue to analyze the impacts of all of these factors on inertia trends.

[1] For each box, the central mark (red line) is the median, the edges of the box (in blue) are the 25th and 75th percentiles, the whiskers correspond to +/- 2.7 sigma (i.e., represent 99.3% coverage, assuming the data are normally distributed. The corresponding lowest inertia in each year is given in the table.

[2] Since low inertia periods in ERCOT are happening at nighttime during low load, high wind periods, solar power is left out in this discussion.

Julia Matevosyan

Lead Planning Engineer

ERCOT

Interesting report! I would like to ask whether there is any publishment about this information I can cite?

Thank you! I’ve made a public presentation about this at the stakeholder meeting, it’s posted here http://www.ercot.com/calendar/2020/2/6/189373-ROS (see item 7 amongst posted presentations at the bottom of the page). I’m also planning on summarizing it in a conference paper, but it won’t be published until this fall.

Very interesting post, Julia!

If penetration of nonsynchronous sources keeps increasing, there could be times in which only the base inertia would be available, accounting for 30% of the critical inertia. Does ERCOT have a plan for managing such situations?

In the UK, National Grid has already had to part-load the largest power indeed or bring online out-of-merit generators to increase inertia, whichever was more economical at a given time. However, they have now created a zero-MW market-based inertia product, where synchronous compensators have been assigned 6-year contracts to provide inertia.

Thank you! For now the plan is, once we start reaching critical inertia during several ours a year, to bring additional (out-of-merit, as you said) generation online, we cannot reduce the largest power infeed because this is nuclear generation that cannot be dispatched down. Once we start getting into such situation more often that will be an indicator that we need some sort of grid support product.

We are closely monitoring the UK Stability Pathfinder initiative as well as non-compulsory grid code requirements for grid forming inverters that National Grid currently has in the stakeholder process and hoping to learn from those experiences.

Currently also weak grid/voltage stability issues are being more binding than inertia, resulting in constraints on inverter-based resource exports from some areas, this is one of the factors that keeps inertia from declining more rapidly as we add more inverter-based resource capacity to the generation mix.

Very interesting reading. What surprise me always is that different technical criteria such inertia, fault level and voltage stability are looked at as if those are independent from each other.

By looking for solutions only adressing inertia or voltage stability or fault level contribution, the technical link between those is forgotten. The UK Pathfinder Stability program is going into the right direction. I am sure we will find soon similar projects in other markets.

Julia, do you know why ERCOT has raised its critical inertia level from 100 GW*s to 200 GW*s per its description in the Business Case for NPRR 1176?