Some topics are exciting to discuss for everybody. Others, well, it takes a select few who can call on their inner geekiness to appreciate. Operating reserve fits that category. It is resource adequacy’s “here and now” operational cousin — capacity above or below what is needed to meet the anticipated system conditions, used during operational time frames just in case things change. It comes in many shapes and sizes … and names. I remember more than a decade ago working with system operators across the world for an International Energy Agency initiative to describe our different methods for operating reserve. We spent six months just figuring out which ones were which across the different regions. In any case, they are a very important part of electric power systems, and an increasingly important part of power systems that are trending toward greater decarbonization. Here I’m going to talk about a few important things about how the methods and definitions are evolving.

Erik Ela

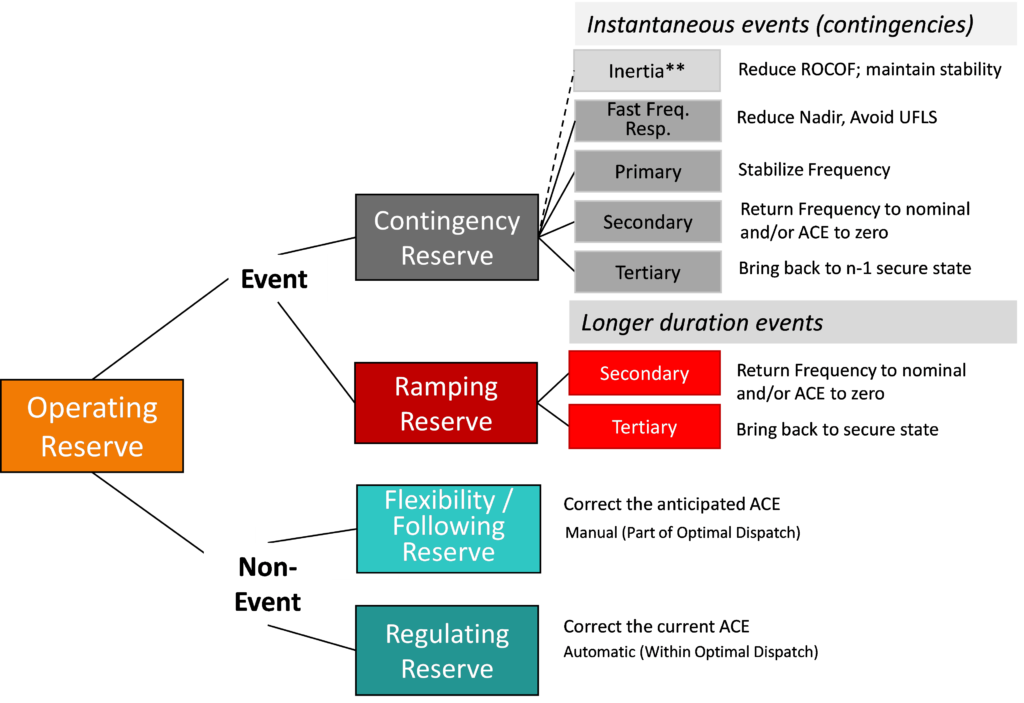

Every balancing area carries operating reserve, which is the aggregate sum of resources providing some headroom (or floor room) to enable ramping in case conditions warrant their deployment. When a generator fails, contingency reserve comes to the rescue. When the net load is varying through the normal variations it faces every day, regulation and flexibility reserve make sure that the system remains balanced. Reserve can be up, down, online, offline, fast, sustaining, frequency responsive, and all sorts of other things. Reserves in market regions are bought and sold through ancillary service markets, with prices based on marginal costs of providing the service including the lost opportunity cost from profit in the energy market. All sorts of resources can provide reserves , including thermal, hydro, storage, and even renewables.

Operating reserve (see the figure below) can help mitigate the challenges with increasing wind and solar on the power system, but we need to think carefully about how. Too little reserve can lead to degraded reliability. Too much reserve leads to excessive costs. There needs to be a Goldilocks point of sorts. Here I’ll talk about that sweet spot, as well as a few key principles around the evolution of operating reserve that should be a part of all considerations of new products, changing requirements, and other operational or market design changes that are being considered as we transition our energy systems.

Figure 1. Example classification of different operating reserve types.

Source: Electric Power Research Institute, used with permission

Dynamic Reserve Requirements: Can You Predict What You May Not Predict?

System operators across the world, utilizing the support of some very good meteorological and statistical gurus and venues such as ESIG’s annual markets and forecasting workshops, have gotten really good at forecasting what the load and wind and solar output are going to be in the next hour, tomorrow, a few days from now, and more. It is part of the power system operation and planning DNA at this point. And yes, we can get things wrong — that’s why operating reserve exists. But what if I told you that you can forecast the operating reserve need, just like you forecast wind, solar, or load? It does sound strange. Reserve helps in the case of the unpredicted, so how can we predict its need? If your reserve method said you should carry 50 MW additional reserve because of solar uncertainty, would you carry that 50 additional MW reserve at night? I hope not. That is a forecast. It can get more complicated than that, and there is information — including historical data, current conditions, and forecasted conditions (including probabilistic ones) — that can be used to help identify what the need is and when. EPRI and others have built tools that forecast dynamic reserve using methods from linear regression to artificial neural networks to compute the reserve need for different times in the future. They show how substantial reliability improvements and cost savings can be achieved compared to using static requirements. Better yet, one can create a dynamic operating reserve demand curve, where not only does the need change, but the associated value for reserve also may change based on conditions. With this design, the operator can efficiently purchase more reserves when they can be purchased at low cost but avoid purchasing too much when their value is low and cost is high.

Reserve Requirements Depend Not Only on Stochastic Variables, but Also the Way in Which You Run the System

Some of the early wind integration studies that have been presented and discussed at ESIG forums over the last two decades shared a lot of information on how to better prepare for wind (and eventually solar) on the bulk system. One important task was determining how much additional wind/solar would increase a system’s reserve requirement. More wind or solar meant more variability and uncertainty to the net load, which generally meant greater amounts of reserve to be carried (how much more and of what reserve types was often a healthy debate). However, two identical systems with the exact same wind/solar/load conditions can have quite different reserve needs. Regardless of whether it’s due to generator availability, wind, solar, load, interchange, or any other variable, reserve is needed due to variability (expected changes) and uncertainty. The way in which you schedule the resources to meet energy, can have just as large an impact on the reserve need.

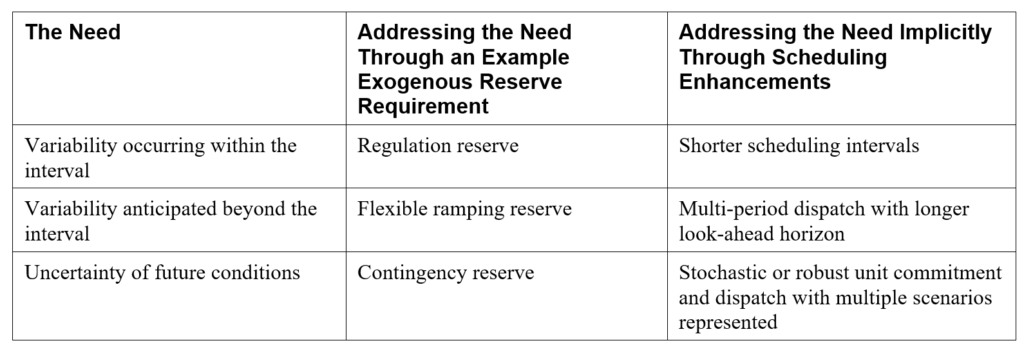

System operator’s scheduling software has grown to become quite sophisticated over the years. The software can actually schedule reserve to meet variability or even uncertainty without calling it reserve! We call this implicit reserve and it is very common. For each of the three reserve needs (we separate variability into intra-interval variability and inter-interval variability), the table below discusses how you can meet the need either through exogenous reserve products or implicit scheduling enhancements. A 15-minute day-ahead market may thus require smaller amounts of reserve than the more common hourly day-ahead market, all else being equal.

Table 1. Three Central Needs for Operating Reserve

Reserve Should Be Based More on Decision Time Frames, Less on Arbitrary Horizons

The suite of reserve products has been increasing of late. I often hear a question in RTO stakeholder committee meetings such as, “What reserve product do we need? A 10-minute, 20-minute, 30-minute reserve?” There are often good reasons for these timing parameters associated with reserve products such as North American Electric Reliability Corporation (NERC) criteria. But, is it possible that a 20-minute product will end up leading to having insufficient reserve at 30 or 10 minutes? Will this lead us in a circle, chasing the changing need through ever increasing products?

So we’ve been promoting the use of newer terminology and reserve definitions. Reserve can be held, as in capacity is in reserve, in one particular time frame. Reserve can then be released, meaning that it no longer needs to be held, in another particular time frame. When released, it can also be deployed, or converted into energy, assuming the reserve was needed. The time frames in which reserve is held and released/deployed should be based on established decision points. Regulation is held in day-ahead and released during the automatic generation control decision time. Contingency reserve is also held in day-ahead, and released by a contingency action event.

Newer products to support impacts due to increased uncertainty for wind and solar (e.g., the California Independent System Operator’s flexiramp) should look at the uncertainty or variability it is being used to correct. Is the reserve being used to correct for day-ahead forecast errors and because day-ahead hourly intervals cannot capture real-time commitment 15-minute intervals? Hold that reserve in the day-ahead and release it in the real-time commitment phase. The other key concept that this reveals, often not implemented on today’s systems, is that reserve requirements do not need to be the same across time horizons. In fact, they really should not be. There is more uncertainty in the day-ahead than there is in the hour-ahead, so there really should be more reserve carried in the day-ahead. If not, then either one time frame is carrying excessive reserve at unnecessary costs, or, worse, one time frame is not carrying enough.

More Reserve, Lower Costs?

We, as power system engineers or operators, carry operating reserve because it can help maintain reliability. But is that all reserve does? Recent research has shown that smart operating reserve requirements can actually be used as a mechanism to reduce costs on systems. Sure, smart reserve will help lower the reserve need during times of low risk, and that can reduce costs due to the need for fewer resources committed online and fewer dispatched out of merit. But I’m here to tell you that increasing your reserve can reduce your costs. When we get better at predicting the need, we can save money by spending a little extra with some cheaper resources providing reserve that can avoid the need to then commit an expensive quick-start resource last minute when it is otherwise the only option.

These cost savings can be significant over time. A recent study for the Hawaiian system of Oahu showed that Hawaiian Electric Company could save $21 to $24 million a year by moving to a dynamic reserve method and allowing their resources to be committed on and off while simultaneously improving their key reliability metrics. That is what we call winner winner chicken dinner!

Surfing the lower cost and better reliability waves and achieving the goldilocks moment. Source: EPRI

Want to learn more? EPRI recently published a publicly available video tutorial where users can listen in and skip to the sections (basic to advanced) that they are most interested in. It uses some animation in some of the latter parts to explain some of these topics more clearly. Reach out to Erik if you have questions or arguments on the topics at eela@epri.com, or of course, if you just like to geek out on operating reserve or other fun topics.

Erik Ela

Program Manager, Electric Power Research Institute

Leave a Reply